When you get your paycheck every two weeks you likely use it to pay important bills right away before letting the rest of your money float around in your bank account. The extra cash might be spent on a night out with friends, an impromptu shopping spree, or on various odds and ends, like coffees and croissants.

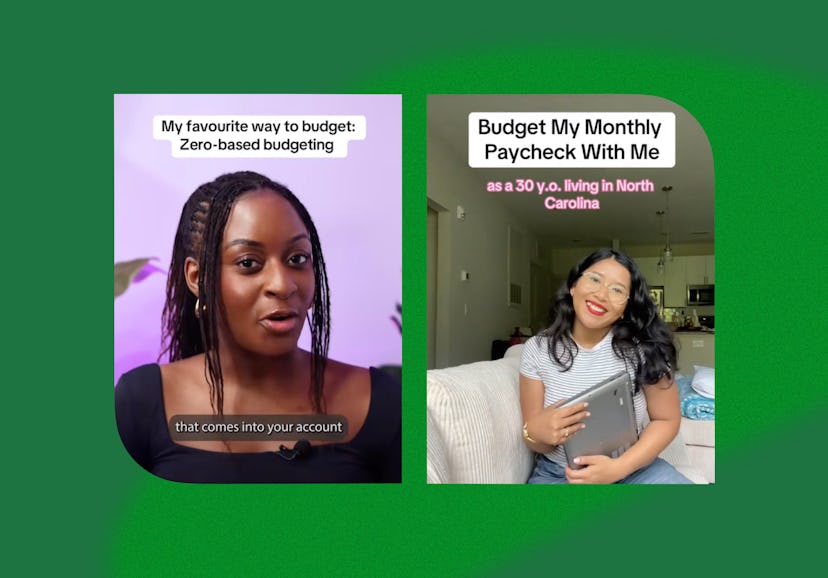

This approach to spending causes your money to trickle away slowly, often leading you to wonder where it all went by the end of the month. “If you’re tired of that happening, you need to start a zero-based budget,” said TikTok creator @hermoneymastery. On the app, the topic of zero-based budgeting (ZBB) is quickly catching on as one of the easiest ways to save. The goal? To allocate every dollar you earn to a certain job.

According to @hermoneymastery, a lot of people are scared of zero-based budgeting because they hear the word “zero” and assume it means they’ll have nothing left in their bank account for fees or last-minute must-haves, but ZBB doesn’t mean you spend all of your money or move it all out of your checking account. Instead, it’s about planning how to use your income.

“If you’re not using a zero-based budget, you’re probably way more stressed about money than you need to be,” said creator @moneywithsaprina in a viral video. But with this hack, you instantly feel more in control. Keep scrolling for the many benefits of ZBB and learn how to get started.

The Benefits Of Zero-Based Budgeting

“Every single dollar that comes into your account should have a job,” said creator @xoxoreni. And that’s the point of ZBB in a nutshell. Instead of paying your bills and then winging it for the rest of the month, this hack is all about divvying up your funds so that you know exactly where each penny is going.

It relieves the mystery of wondering what you’re paying for, as well as the stress that comes with not setting aside enough cash to pay important bills before your next paycheck.

According to @moneywithsaprina, this plan works whether you have $500 or $5,000 because most budgeting systems have you look at your expenses based on an entire month, while this one allows you to work with the money you already have in your account. This allows you to tackle your budget in smaller chunks.

With ZBB, “you’re going to take the money you have right now and ask yourself, ‘What do I need this money to do for me between now and the next time I get paid?’ And then you’re going to assign that money, divided up, amongst the priorities that you set,” she said. “You’re going to give every dollar a job until you reach zero, hence the name zero-based budget.”

This is an ideal approach if you need to pay high-priority bills before your next paycheck comes in or if you need to stretch your income, but the ZBB hack also works well if your paycheck is higher. If you want to stay organized, it’s a dream come true.

For example, creator @lifewithbethanny brings in $3,800. On the first day of the month, she’ll set aside money for her rent, utilities, phone bill, car insurance, pet insurance, monthly subscriptions, car payment, and credit card bill, keeping track of it all on her laptop. She also puts a set amount of cash into a high-yield savings account and a Roth IRA.

After covering all her bases, she has $800 left over, which she divvies up among other monthly expenses like gas, groceries, auto care, pet care, and fun, like going to parties. Each category gets a set budget per month.

Not only does ZBB help you keep track of where your money is going, it also prevents you from overspending, since each dollar is accounted for. If you allocate $100 a month for going out, it requires you to be more mindful. Did you blow your budget at happy hour? Then you’ll have to wait until your next paycheck before you go out again.

How To Do Zero-Based Budgeting

To try ZBB, start by listing all of your set monthly expenses, like rent, car payment, utilities, credit card bill, subscription services, etc. Even if some of these amounts change each month — like when you pay more for heating in the winter — you’ll write it down and keep track of it. These are your non-negotiables that need to be paid for.

Next, you’ll give yourself a budget for the other areas of your life. Think $300 a month for groceries and $100 for eating out. You can keep a set amount in your checking account at all times, too, and that’ll also factor into what’s subtracted from your paycheck.

Assign your money to different categories and keep going until you’re down to zero, allocating every penny you earn to a specific job. Since zero-based budgeting means keeping track of everything you pay for, you should instantly feel more organized.